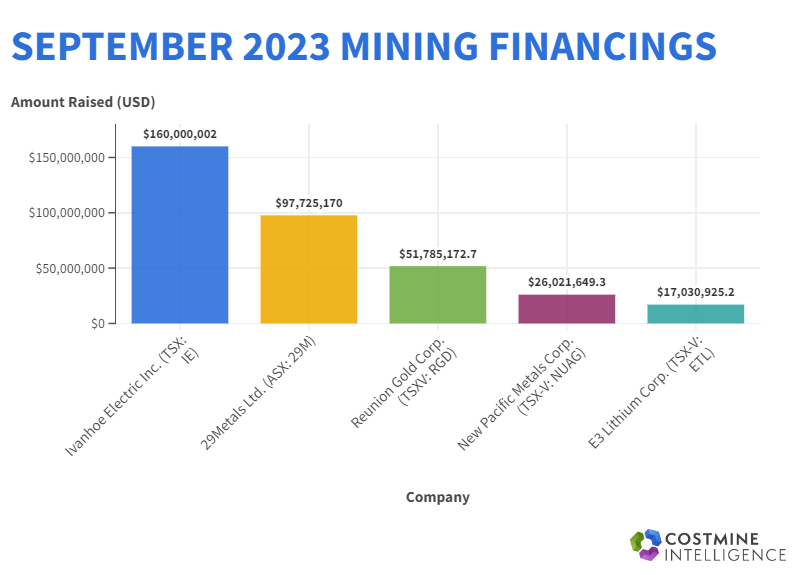

Each month Costmine Intelligence tracks the top mining financings around the world. In September, there were 103 financings closed that amounted to USD $1,173,373,365.90. We picked out the top 5 for a snap shot of where money is going.

#1) Ivanhoe Electric (TSX: IE) intends to use the net proceeds for a preliminary feasibility study on the Santa Cruz Copper Project in Arizona, USA, as well as for mineral rights payments, drilling and other exploration activities and for other working capital and general corporate purposes.

#2) 209Metals’ (ASX: 29M) financing is to bolster the company’s financial position, fund the Capricorn Copper Recovery Plan and near-term Golden Grove copper-zinc capital projects in Australia, whilst de-risking the balance sheet, positioning the company to deliver future production.

#3) Reunion Gold Corp. (TSX-V: RGD) closed its “bought-deal” public offering of common shares, with La Mancha Investments who is now a shareholder. They intend to use the net proceeds from the Offering for continued advancement of the company’s Oko West Gold Project in Guyana and for general corporate purposes.

#4) New Pacific Metals Corp. (TSX-V: NUAG) closed a bought deal financing, Silvercorp Metals (TSX: SVM) now owning 27.4% and Pan American Silver (TSX: PAAS) with ~ 11.6% of the outstanding common shares of the company. Net proceeds of the offering will be used to advance exploration and development at the Silver Sand and Carangas silver projects in Bolivia and for operating expenses.

#5) E3 Lithium Corp. (TSX-V: ETL) plans to use the proceeds from the bought deal public offering towards the advancement of the Clearwater Lithium Project in Alberta, Canada and corporate development activities.