Inflation is rampant across all industries and people are starting to feel the pinch. It is dramatically increasing the cost of living. As the industry that produces the materials of modern living, mining is not immune from inflation, if anything it is the first place to look for the costs coming down the pipeline.

According to Costmine analyst, Brad Terhune, costs are not only increasing but they have been accelerating over the past couple of years. It is getting more expensive to build and operate a mine.

Costs Are Rising and Accelerating

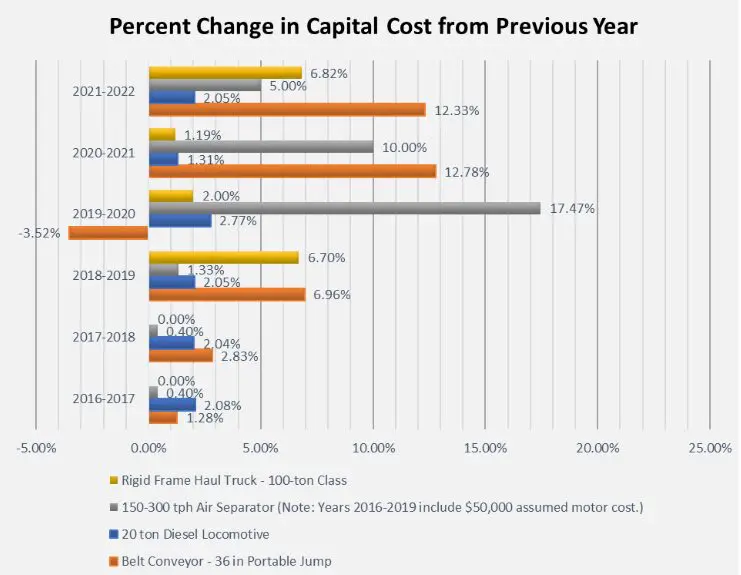

According to a recent Costmine analysis, there is an accelerating upward growth in capital costs in the second half 7-year window of the study. There are two exceptions, conveyors and locomotives.

Conveyors are used to transport ores, concentrates and tailings across different stages of the mining cycle. Belt conveyors transport ore to feed processing plants and materials to stockpiles. Diesel locomotives move ore cars and crews in underground mines.

The conveyor has seen the largest cost increases on a percentage basis over much of the 7-year time frame. It is eclipsed only by the locomotive in 2017 and by all pieces in 2020 due to it being the only item seeing a reduced cost that year.

While the cumulative tally for all equipment pieces in 2022 is $2,700,100 versus $2,224,555 in 2016, it is clear that costs did not change uniformly for all equipment types over the period studied. The average increase across the four equipment types is 31.6%.

The rising and accelerating capital costs are rapidly dating many mining economic studies for development projects while operating costs are throwing another wrench into estimates.

Do You Estimates Early and Do it Often

Cost estimators in the mining industry know that costs escalate over time and that it is best to avoid delays in development decisions. The costs for developing a project today are substantially higher than it would have been just three to four years ago.

According to data from Mining Intelligence there were 332 technical documents filed over the same 7-year period of the Costmine study. The question one would ask is do these technical documents include and account for the rapid rate of inflation?

The capital needed to build mines will change as costs rise, leaving investors feeling as a perpetual faucet from which mining companies tap for new capital. A mining project financed years ago may need to relook at their economics while investors reconsider their portfolio.

With an already looming supply gap for several key critical metals and minerals, the cost of the energy transition just increased.

Costmine works every day to capture the latest in mining costs with an extensive network built over years. If you are interested in the latest in cost estimate data, check out its Mining Cost Service for a demo.